Kentucky Ag News

Time for cattle producers to weigh winter backgrounding opportunities

University of Kentucky College of Agriculture, Food and Environment

LEXINGTON, Ky. – In a typical year, light-weight calf prices decline from summer to fall and make their annual lows during the fourth quarter. The year 2013 has been a bit different as corn prices have decreased significantly since summer, which is due to the large 2013 corn crop. The result has been a continual strengthening of the calf and feeder cattle markets during the last few months. It is possible that many backgrounders have been hesitant to place calves into winter programs as they have not seen the usual decrease in calf prices. The purpose of this article is to examine potential returns to backgrounding programs during this unusual time of high prices.

At the time of this writing (October 23, 2013), spring 2014 feeder cattle futures were trading in the mid-upper $160s. As winter backgrounders consider purchasing calves today, they should be looking at these feeder cattle futures contracts for likely sale prices in the spring. A futures price in the mid-upper $160s suggests a likely Kentucky price for 850 lb steers in the low- to mid-$150s come spring: an expected sale value of $1,292 (850 pounds x $1.52). This should be in the back of producer’s minds as they bid on calves this fall.

While calf prices are highly variable, sales during mid-October have suggested that a good group of 550-pound steer calves could likely have been put together for $160-170 per hundredweight (cwt). If so, using the midpoint would result in a purchase price per head of $908 (550 pounds x $1.65). Based on current calf prices and spring futures prices noted above, the market appears to be offering gross margin (expected spring feeder value minus calf purchase price) of around $375-400 per head. As backgrounders consider placing calves right now, they should be asking themselves if they can make an acceptable return at this gross margin level.

Next, let’s consider the likely costs of wintering these calves from now until spring. The largest and most obvious cost is feed. Producers should consider all potential feeding options, but we will look at a single program where calves are fed 1.5% of their body weight of a 50 / 50 corn gluten / soy hull mix, and another 1.5% of their body weight of grass hay. While performance will vary, we will assume a rate of gain of approximately 2.3 pounds per day, which suggests 300 pounds can be put on in approximately 130 days.

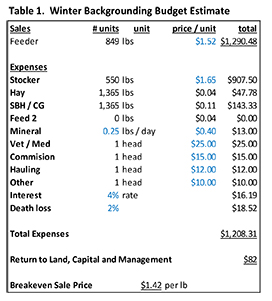

In terms of costs, we will value the corn gluten / soy hulls at $210 per ton and value the grass hay at $70 per ton. Health costs are assumed to be $25 per head, commission is set a $15 per head, and transportation is set at $12 per head. An interest charge of 4% is included, and death loss is assumed to be 2%. Of course, all these prices and costs will vary by location and operation, so readers are encouraged to come up with their own estimates. Furthermore, cow-calf operators backgrounding their own calves would likely have reduced veterinary and medicine, commission, and death loss costs. The following table shows expected returns to the program described above.

As can be seen in table 1, a decent return is possible for winter backgrounding programs this winter, based on the assumptions discussed previously. Producers are strongly encouraged to modify these assumptions for their individual programs and update cost estimates and feed prices for their area. It is also worth noting that labor, depreciation, and interest on owned capital are also not included in the budget. Hence, the return is a return to land, capital, and management. Breakeven sale price reported is the selling price needed to cover variable expenses listed.

Of course, two of the key assumptions made in Table 1 are the cost of the calves being placed and the expected sale value in the spring. A $5-per-cwt increase in the purchase price of the calves would decrease returns by $27.50 per head, making placement price very important. Winter backgrounders should carefully calculate their breakeven purchase prices for calves and be opportunistic as they approach this fall.

Moreover, a decrease in expected sale price of $5 per cwt would decrease returns by $42.50. Note, given the $81 expected return, a decrease in expected sale price of $10 per cwt would be the difference in making money and losing money on the winter program. This sale price also has the most potential to change in the coming months. For this reason, winter backgrounders are also encouraged to explore opportunities to manage downside price risk through futures and options markets, LRP insurance, and other strategies. While opportunities to make money exist, price risk is high, and preserving some of those expected profits should definitely be a management goal.

This article was written by

Kenny Burdine and Greg Halich, agriculture economists in the University of Kentucky

College of Agriculture, Food and Environment. The article first appeared in the

October 25 edition of Economic and Policy

Update.